Welcome to the world of free printable forms! Today, we are excited to share with you a free printable W9 form for the year 2016. This form is available in a downloadable format that you can easily print out from the comfort of your own home. With this W9 form, you’ll be able to keep track of all your financial records and stay up-to-date with all your tax obligations.

What is a W9 Form?

A W9 form is an official Internal Revenue Service (IRS) document that is used to keep track of your income. This form is required for those who work as independent contractors or freelancers and must be filed with the IRS each year. By filling out this form, you will be asked to provide your name, address, social security number (or taxpayer identification number), and other information related to your finances.

Many people use the W9 form as a way to keep track of their earnings, expenses, and other financial information for their records. It is also a way to comply with the IRS regulations and avoid any penalties or fines.

Many people use the W9 form as a way to keep track of their earnings, expenses, and other financial information for their records. It is also a way to comply with the IRS regulations and avoid any penalties or fines.

How can you fill out the W9 Form?

The W9 form is a straightforward document that is easy to fill out. You only need to provide accurate and up-to-date information, and then you can submit it to your employer or any other entity that requires this kind of document.

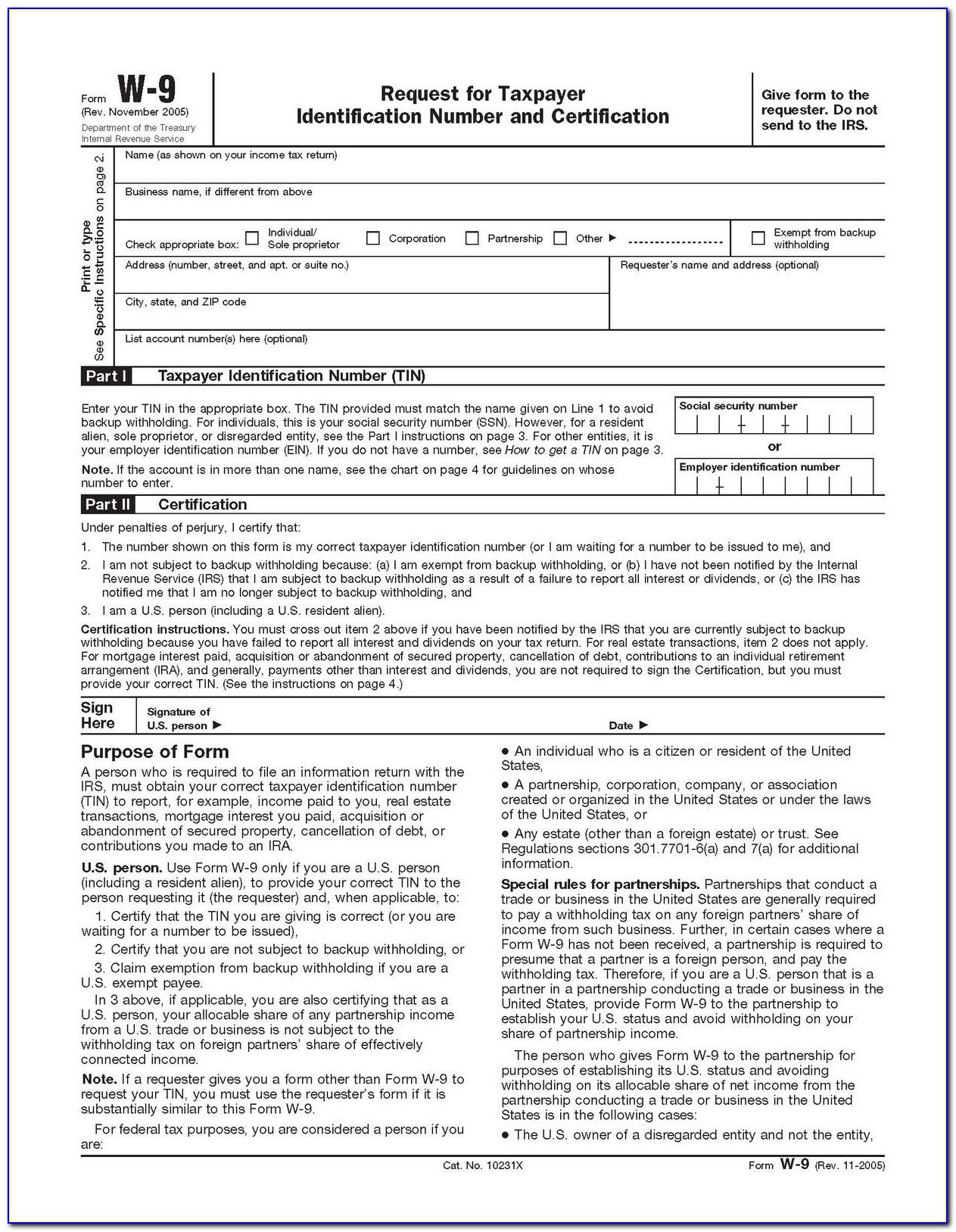

The W9 form consists of several sections. The first section requires you to enter your name, address, and business name (if applicable). The second section is where you need to provide your taxpayer identification number (TIN). This can either be your social security number or your employer identification number (EIN).

The third section is where you need to specify your business type. This can be a sole proprietorship, an LLC, a partnership, or any other type of business entity. The fourth section is where you need to provide your exemption status.

Once you have filled out the W9 form, you can submit it to your employer or any other entity that requires it. Make sure to keep a copy of the form for your records.

Once you have filled out the W9 form, you can submit it to your employer or any other entity that requires it. Make sure to keep a copy of the form for your records.

What are the benefits of using a W9 form?

There are many benefits to using a W9 form. For one, it allows you to keep track of your financial records and stay compliant with the IRS regulations. By filling out this form, you can also avoid any penalties or fines that may result from inaccurate or incomplete financial information.

Additionally, the W9 form can help you avoid any misunderstandings or disputes with your employer or other business entities. By providing accurate and up-to-date financial information, you can ensure that you are paid properly and in a timely manner.

Conclusion

Conclusion

If you are a freelancer or independent contractor, it is vital that you stay up-to-date with your financial records. The W9 form is an essential document that can help you keep track of your income, expenses, and other financial information. By filling out this form, you can stay compliant with the IRS regulations and avoid any penalties or fines.

Here at Free Printable, we are dedicated to providing you with the latest and most accurate free printable forms to help you manage your financial records. We hope that this free printable W9 form for the year 2016 has been helpful to you, and we invite you to explore our website for more free printable forms and templates!